Hey everyone! I’m Adnan from The Insurtech Guide. Let’s talk about the fundamental problem with traditional insurance: a built-in conflict of interest. You pay a company money, hoping you never have to ask for it back. The insurance company, on the other hand, profits most when it doesn’t have to pay you. This creates a system where the two parties are naturally at odds.

But what if there was a model built on community and trust instead of conflict? That’s the revolutionary idea behind one of the most exciting trends in InsurTech: Peer-to-Peer (P2P) Insurance.

I’ve been fascinated by this concept because it flips the old model on its head. In this guide, I’ll answer the question what is P2P insurance in the simplest terms possible and explore its real potential to change the industry.

Table of Contents

What is P2P Insurance? The Core Idea Explained

At its heart, P2P insurance is a modern take on a very old idea: a group of people with a similar risk (like friends, colleagues, or people in the same neighborhood) pool their money together to protect themselves.

Here’s the simplest analogy I can think of: Imagine you and nine friends all put $20 into a glass jar to cover the cost of a cracked phone screen. At the end of the year, if only one person cracks their screen and uses $100 from the jar, the remaining $100 is split and returned to everyone. That’s the basic spirit of P2P insurance. It’s a community-based risk sharing pool.

How Does It Actually Work in the Real World?

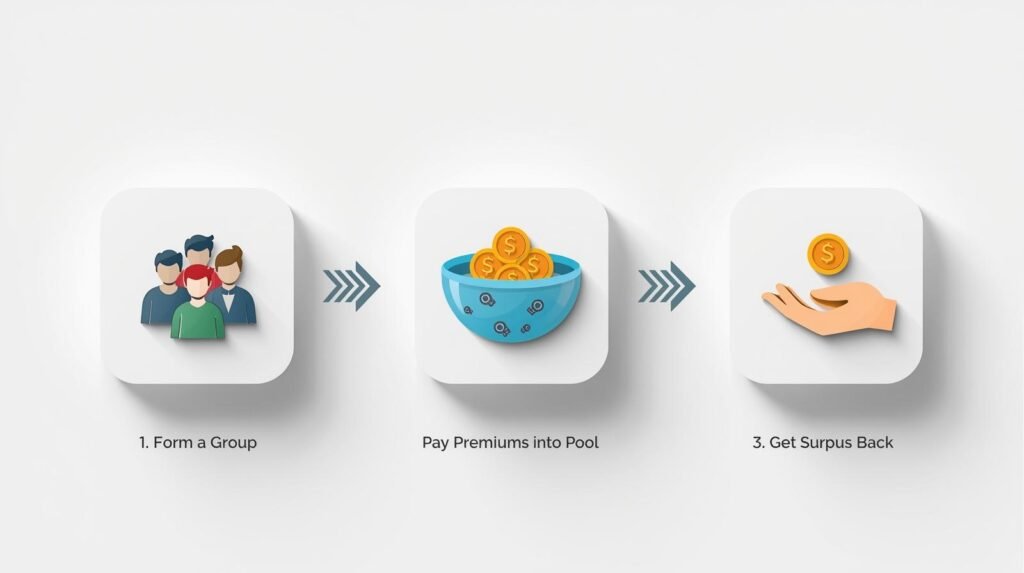

The real-world P2P insurance model is a bit more structured, but the principle is the same. Here’s the typical process:

1. You Join a Small Group (The Pool):

When you buy a policy, you are grouped with other like-minded individuals. For example, a group could be for bicycle owners or drone hobbyists.

2. Your Premium is Split:

A portion of your premium goes into your group’s shared pool to cover small, everyday claims. The other, larger portion goes to a major reinsurance company. This is a crucial safety net—it means that if a huge, catastrophic claim occurs that wipes out your small pool, there is still a big, traditional insurer there to pay the claim.

3. The Leftover Money is Returned:

This is the magic of the P2P model. At the end of the year, if your group had fewer claims than expected, the leftover money in the pool doesn’t go to the insurance company as profit. Instead, it is returned to the members of the pool (as a discount or a rebate) or donated to a charity of the group’s choosing. Lemonade’s famous “Giveback” program is a perfect example of this principle in action.

The Main Advantage of P2P Insurance: No More Conflict of Interest

The biggest benefit of the P2P model is that it almost completely eliminates the traditional conflict of interest.

- The company makes its money from a flat fee, not from denying claims.

- Because the members of the pool get the leftover money back, there is a natural social incentive to be honest and not file fraudulent claims.

- It turns the relationship from “me vs. the company” to “us as a community.”

So, Could It Replace Traditional Companies? The Reality Check

While the P2P model is powerful, it’s unlikely to completely replace the giants of the insurance world anytime soon. Here are some of the challenges for P2P insurance:

- Scaling: Managing thousands of tiny, independent pools is administratively complex.

- Regulation: The insurance industry is heavily regulated, and this new model is still finding its place within the rules.

- Capital: You still need a massive traditional reinsurer in the background to handle the big risks, which means P2P can’t exist entirely on its own.

Instead of a replacement, I believe we’ll see a hybrid future. More InsurTech companies will adopt P2P principles—like Lemonade has—to create more transparent and customer-friendly products.

The verdict for “what is P2P insurance?”: It’s a powerful and fair idea that is forcing the entire industry to be better. While it may not be a revolution that topples the old giants, it’s a vital evolution that is putting the community back at the heart of insurance.

Leave a Reply