Hey everyone! I’m Adnan from The Insurtech Guide. Every time an insurance claim is filed anywhere in the world—for a car accident, a house fire, or a stolen laptop—it becomes a tiny piece of a massive, global puzzle. For centuries, this data was just stored away in dusty filing cabinets. But today, InsurTech companies are using the power of AI to piece this puzzle together.

This “behind-the-scenes” process is known as insurance claims data mining. It’s one of the most powerful and least understood forces shaping the future of the industry. As someone fascinated by how data can reveal hidden truths, I decided to investigate how this technology works.

How can the details of a claim from ten years ago help predict a future risk? It’s a fascinating process of finding patterns in the chaos. In this guide, I’ll break down what insurance claims data mining is and how it’s being used to create a smarter, more predictive insurance industry.

Table of Contents

What is Insurance Claims Data Mining?

At its core, insurance claims data mining is the process of using powerful AI and machine learning algorithms to analyze vast amounts of historical claims data to identify patterns and predict future risks.

Think of it like being a detective. A single clue might not mean much. But when you gather thousands of clues, you can start to see a clear picture of what happened—and what is likely to happen next. Insurers are no longer just looking at individual claims; they are analyzing the entire history of claims to get a much deeper understanding of risk.

3 Ways Data Mining is Being Used to Predict Risk

From my research, I found that this technology has three main applications that are revolutionizing the industry.

1. More Accurate Underwriting and Pricing

This is the biggest and most immediate impact. Traditionally, insurers used broad categories (like age and zip code) to set your premium. Data mining allows for a much more granular and accurate approach.

- How it works: An AI can analyze ten years’ worth of claims data and discover patterns that humans would never see. For example, it might find that a specific car model has a statistically higher rate of expensive transmission failures after 80,000 miles.

- The Impact: When you apply for insurance for that car, the insurer can use this data to give you a more accurate premium. It allows for a move from “one-size-fits-all” to hyper-personalized pricing.

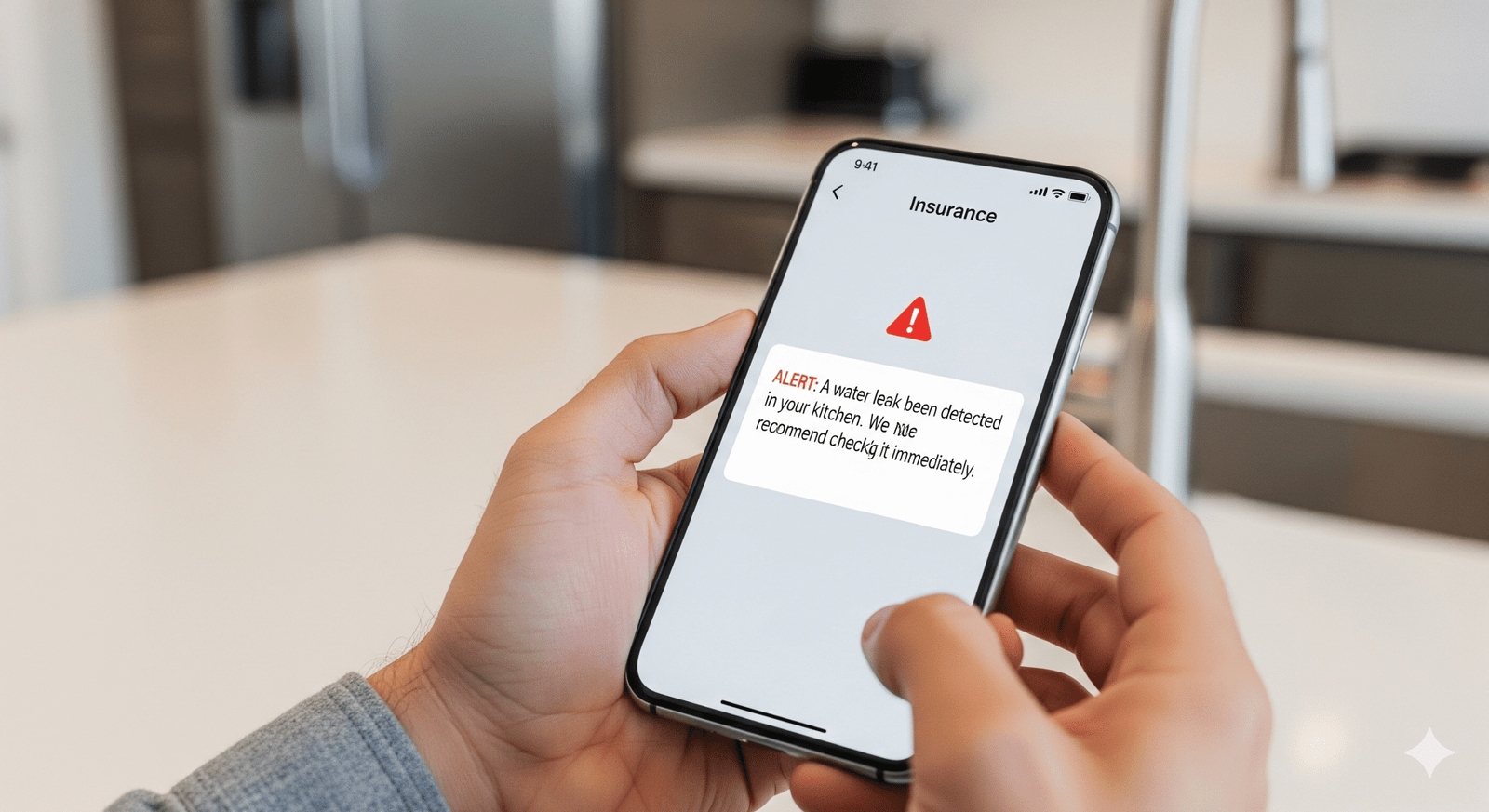

2. Proactive Risk Prevention

This is where insurance claims data mining becomes truly exciting and proactive. By understanding the root causes of past claims, insurers can help current customers prevent them from happening in the first place.

- How it works: The AI might analyze thousands of water damage claims and discover that a certain brand of washing machine hose is responsible for a disproportionate number of floods.

- The Impact: The insurance company can then send a targeted alert to all their customers who own that washing machine model: “We’ve noticed a high failure rate for this hose. We recommend inspecting it or replacing it to prevent a potential flood.” This turns the insurer from just a payer of claims into a proactive partner in home safety.

3. Faster, Smarter Fraud Detection

We’ve discussed how AI detects fraud in individual claims, but data mining takes it a step further by looking at patterns across the entire system.

- How it works: An AI can mine claims data to identify networks of fraudulent activity. It can flag a specific auto repair shop that consistently bills for more expensive parts than are needed for a certain type of damage, or a medical clinic that is part of a fraud ring.

- The Impact: By identifying these large-scale patterns, insurers can stop organized fraud at its source, which saves everyone money in the long run.

Final Verdict: A Smarter Future for Insurance

Insurance claims data mining is a powerful, “behind-the-scenes” force that is making the industry more intelligent, accurate, and proactive. By learning from the past on a massive scale, insurers are getting better at predicting the future.

For us as customers, this means a future with fairer, more personalized premiums and an insurance company that acts as a true partner in helping us avoid risk. It’s a key part of the InsurTech revolution that is creating a smarter and safer world for everyone.

Leave a Reply