Hey everyone! I’m Adnan from The Insurtech Guide. For decades, a fundamental unfairness has been baked into the insurance system. Where you live, your credit score, or even your level of education can have a bigger impact on your car insurance premium than how you actually drive. This is biased insurance pricing, and it means millions of responsible people are overpaying simply because of who they are, not how they act.

As someone who believes technology should make things fairer, I’ve been closely following the one trend that promises to fix this problem: AI-powered underwriting. The big promise is that an intelligent algorithm can look at you as an individual, not as a stereotype.

But is it really that simple? Can AI underwriting to eliminate bias truly work, or does it risk creating new kinds of discrimination? I’ve explored the technology and the ethical questions to bring you a clear, honest look at the future of fair insurance.

Table of Contents

The “Old Way”: How Bias Creeps into Traditional Underwriting

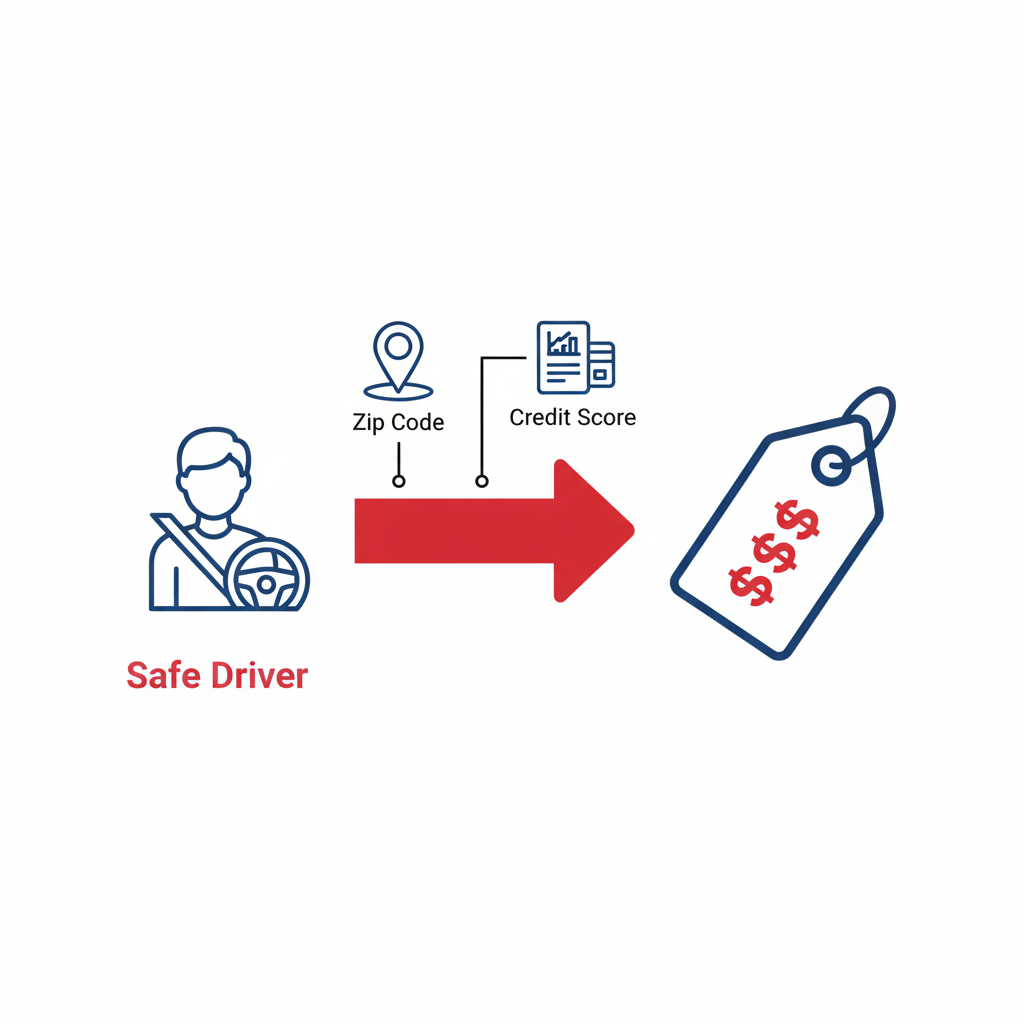

To understand the solution, we first need to understand the problem. Traditional underwriting relies on proxy data. Since an insurer can’t follow you around to see if you’re a responsible person, they use proxies—or statistical stand-ins—to guess.

These proxies often include:

- Credit Score: The theory is that people with good credit are more responsible. But a low credit score can be due to a medical emergency or a job loss, not irresponsibility.

- Zip Code: Living in a certain neighborhood can dramatically increase your premium, even if you’ve never had an accident.

- Education Level & Occupation: These are also used to predict risk.

The problem is that many of these factors are closely tied to socioeconomic status and race, which leads to a system where good drivers in poor neighborhoods can pay more than risky drivers in wealthy ones. It’s a system that judges a group, not the individual.

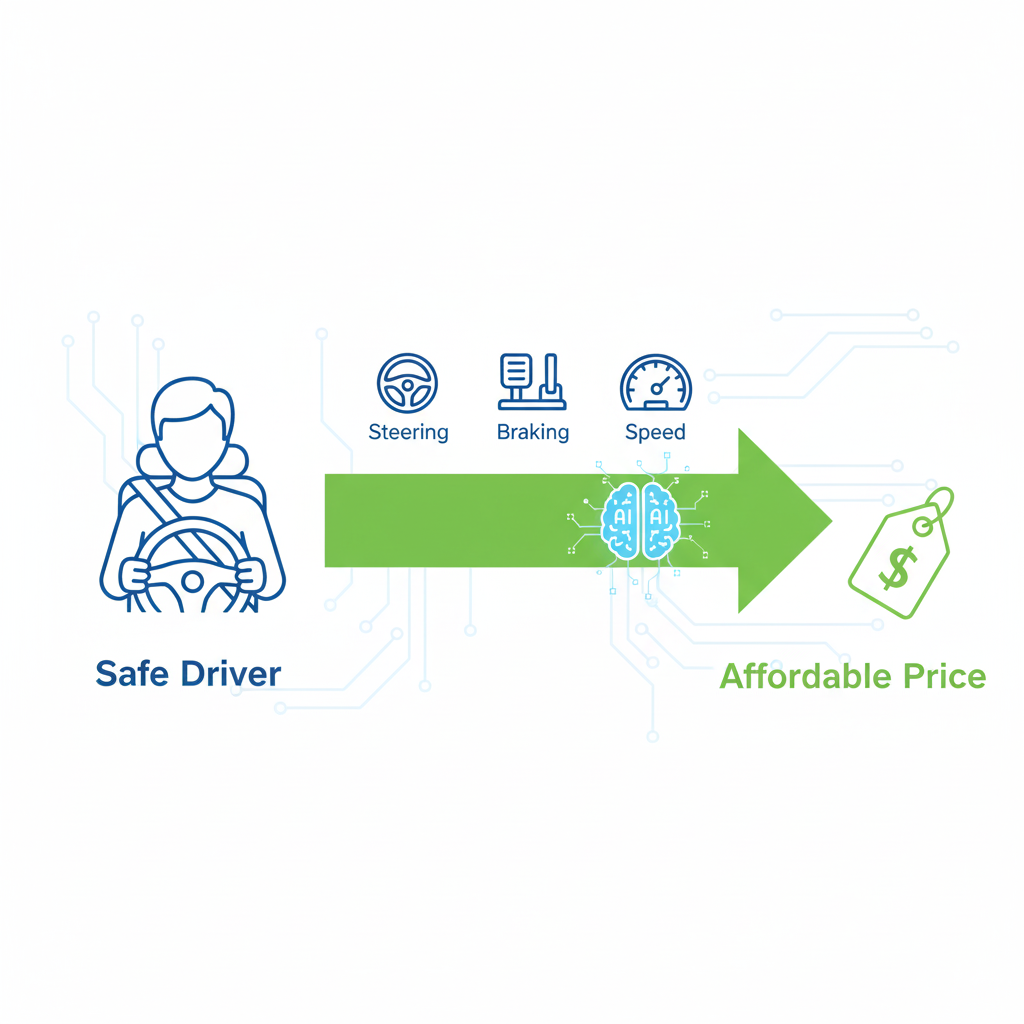

The AI Solution: Focusing on Behavior, Not Demographics

This is where AI underwriting changes the game. Instead of relying on broad, often unfair proxies, AI can analyze individual behavioral data to determine your true risk.

Here’s how AI underwriting to eliminate bias is designed to work:

1. Using Telematics Data (How You Actually Drive)

Instead of your credit score, an AI-powered insurer (like Root or Metromile) uses telematics data from your phone to see how you actually drive. It measures factors that are directly related to risk:

- Do you brake harshly?

- Do you speed?

- Do you take corners too fast?

- Do you use your phone while driving?

Based on my experience with these apps, my premium was based on my actions, not my background. The AI doesn’t care about my zip code; it cares about my driving score.

2. Removing Biased Data from the Algorithm

The most crucial step is that developers can intentionally exclude biased proxy data from their machine learning models. A truly fair AI model can be programmed to be “blind” to your credit score, your neighborhood, and your education level. It can be forced to calculate your premium based only on factors that you, as an individual, can control.

3. Continuous, Fair Assessment

Unlike a traditional policy where your rate is set for 6-12 months, an AI model can continuously assess your risk. If you improve your driving habits, your premium can go down at the next renewal, offering a fair path to a better rate based on merit.

The Big Challenge: The “Black Box” Problem

While the potential is huge, it’s not without challenges. The biggest concern in the industry is the “black box AI problem.” Some advanced machine learning models are so complex that even their creators don’t know exactly why they made a certain decision.

This creates a risk that the AI could unintentionally find new, hidden proxies for the old biases. Regulators and ethical AI developers are working hard to create transparent and explainable AI to ensure the underwriting process is truly fair and understandable. Creating transparent and explainable models is the biggest hurdle for AI underwriting to eliminate bias.

Final Verdict: A Tool for a Fairer Future

So, can AI underwriting to eliminate bias really work? Yes, I believe it can, and it’s already starting to.

While we must be vigilant about the “black box” problem, the ability of AI to focus on individual behavior over demographic proxies is the most powerful tool we’ve ever had to fight systemic bias in the insurance industry. By judging us on what we do, not who we are or where we live, AI has the potential to make insurance not just smarter, but finally, truly fair.

Leave a Reply