Hey everyone! I’m Adnan from The Insurtech Guide. We’ve recently talked about how IoT devices are making insurance more “proactive” by preventing small household disasters like leaks. But as I’ve been following the industry, I’ve seen the start of something much bigger: using Artificial Intelligence to tackle the most destructive forces on our planet—natural disasters.

For centuries, insurance has been a reactive force. A hurricane or wildfire strikes, and insurers pay for the aftermath. But what if we could predict the path of a wildfire with pinpoint accuracy or warn a homeowner of a potential flood weeks in advance? This is the groundbreaking role of AI in natural disaster prediction for insurance.

As someone who is deeply invested in how technology can make us safer, I’ve been researching this incredible trend. Is it possible to move from just paying for disasters to actively preventing them on a massive scale? Here’s what I’ve learned.

Table of Contents

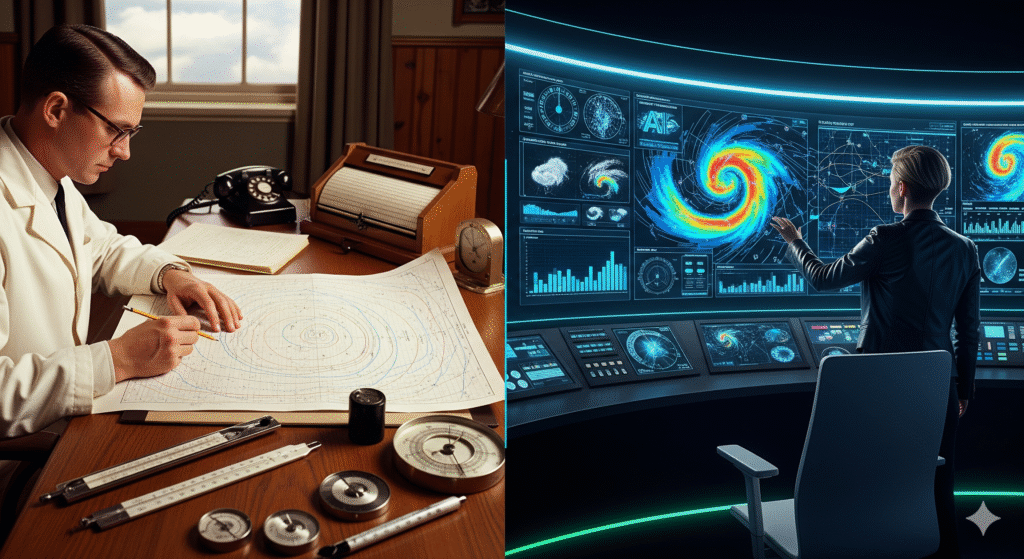

The Old Way: A Look into the Past

Traditionally, insurers have used historical data and statistical models to predict risk. They would look at which areas have flooded in the past 50 years to determine the risk for today. While useful, this method is becoming less reliable in the face of rapid climate change. Past data is no longer a perfect predictor of future events. This is where AI changes the game.

How AI is Revolutionizing Disaster Prediction

AI, specifically machine learning, doesn’t just look at the past; it learns from vast amounts of real-time data to find complex patterns that humans never could. The role of AI in natural disaster prediction for insurance is not just an upgrade; it’s a complete paradigm shift.

Here are a few of the applications I’ve found most impressive:

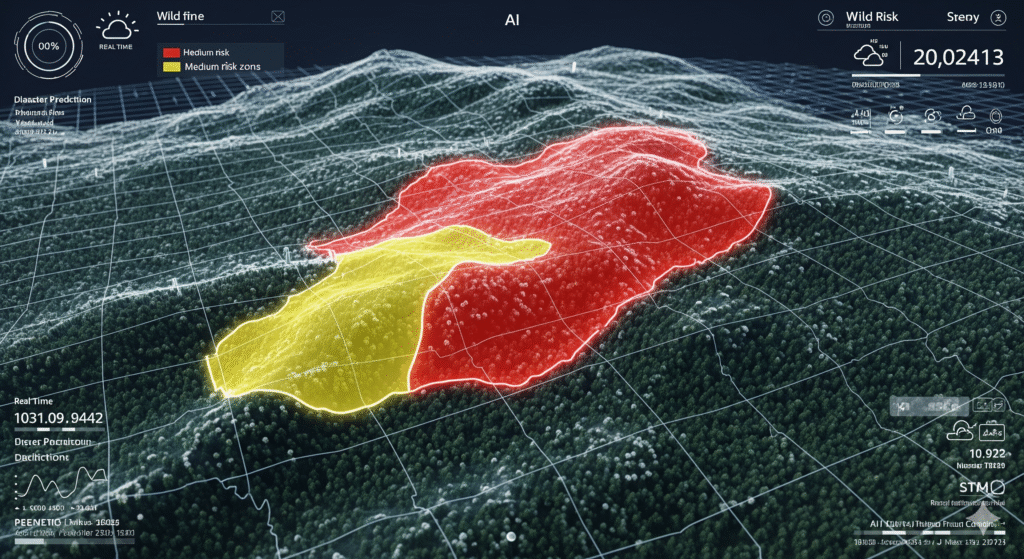

1. Hyper-Accurate Wildfire Prediction

- How it works: AI algorithms can analyze satellite imagery, weather patterns, humidity levels, and even social media posts in real-time. By combining this data, companies like Zesty.ai can assign a specific wildfire risk score to every single property.

- The Proactive Difference: Instead of just knowing you live in a “high-risk state,” your insurer could tell you that your specific property is at risk due to dry vegetation nearby. They could then offer you a discount for creating a defensible space around your home, actively helping you prevent a loss.

2. Advanced Flood and Hurricane Modeling

- How it works: AI can analyze topographical data, river levels, and storm surge forecasts with incredible precision. It can model exactly how a flood might affect a specific neighborhood, street by street.

- The Proactive Difference: I’ve seen examples where an insurer could send a targeted alert to a homeowner days before a storm: “Our AI model predicts a 70% chance of flooding on your street. We recommend moving valuables to a higher floor and placing sandbags.” This early, specific warning is something old models could never provide.

3. Real-Time Hail Damage Assessment

- How it works: After a hailstorm, instead of sending adjusters to every home, AI can analyze high-resolution aerial or satellite images taken immediately after the storm. The AI is trained to recognize the specific patterns of hail damage on roofs.

- The Proactive Difference (Post-Event): While this is after the event, it’s proactive in the claims process. Your insurer could contact you and say, “We’ve detected severe hail damage to your roof. We have pre-approved your claim and a contractor will be in touch.” This turns a weeks-long claims process into an almost instant one.

The Future: From Prediction to Prevention

The ultimate goal of using AI in natural disaster prediction for insurance is not just to get better at forecasting; it’s to build a safer world.

- Smarter Underwriting: Insurers can offer fairer, more accurate premiums based on a property’s true risk, not just its zip code.

- Incentivizing Safety: They can offer tangible financial rewards (lower premiums) to homeowners who take preventative measures, like installing storm shutters or using fire-resistant roofing materials.

- Saving Lives: The most important role of AI will be providing early and accurate warnings that give people more time to evacuate and protect their families.

This isn’t about replacing human experts; it’s about giving them superpowers. By harnessing the predictive power of AI, the insurance industry has the potential to transform from a financial safety net into a proactive guardian against the worst that nature can throw at us.

Leave a Reply