Hey everyone! I’m Adnan from The Insurtech Guide. If you’re like me, you probably have insurance policies scattered everywhere—car insurance with one company, renters with another. Managing them is a hassle, and shopping for a better deal feels like a full-time job. That’s where all-in-one insurance management apps and comparison tools like The Zebra or Gabi come in.

They promise a simple, beautiful dream: enter your information once, and instantly compare dozens of quotes to find the absolute best price. They position themselves as your unbiased friend in the confusing world of insurance. But I’ve always had a nagging question in the back of my mind: Are they actually unbiased? Or is there a catch?

To find out, I went on a deep dive. I tested these platforms, read their terms of service, and investigated their business models. In this insurance management app review, I’ll share what I learned and answer the big question: can you really trust them?

Table of Contents

How Do These Apps Actually Work (And Make Money)?

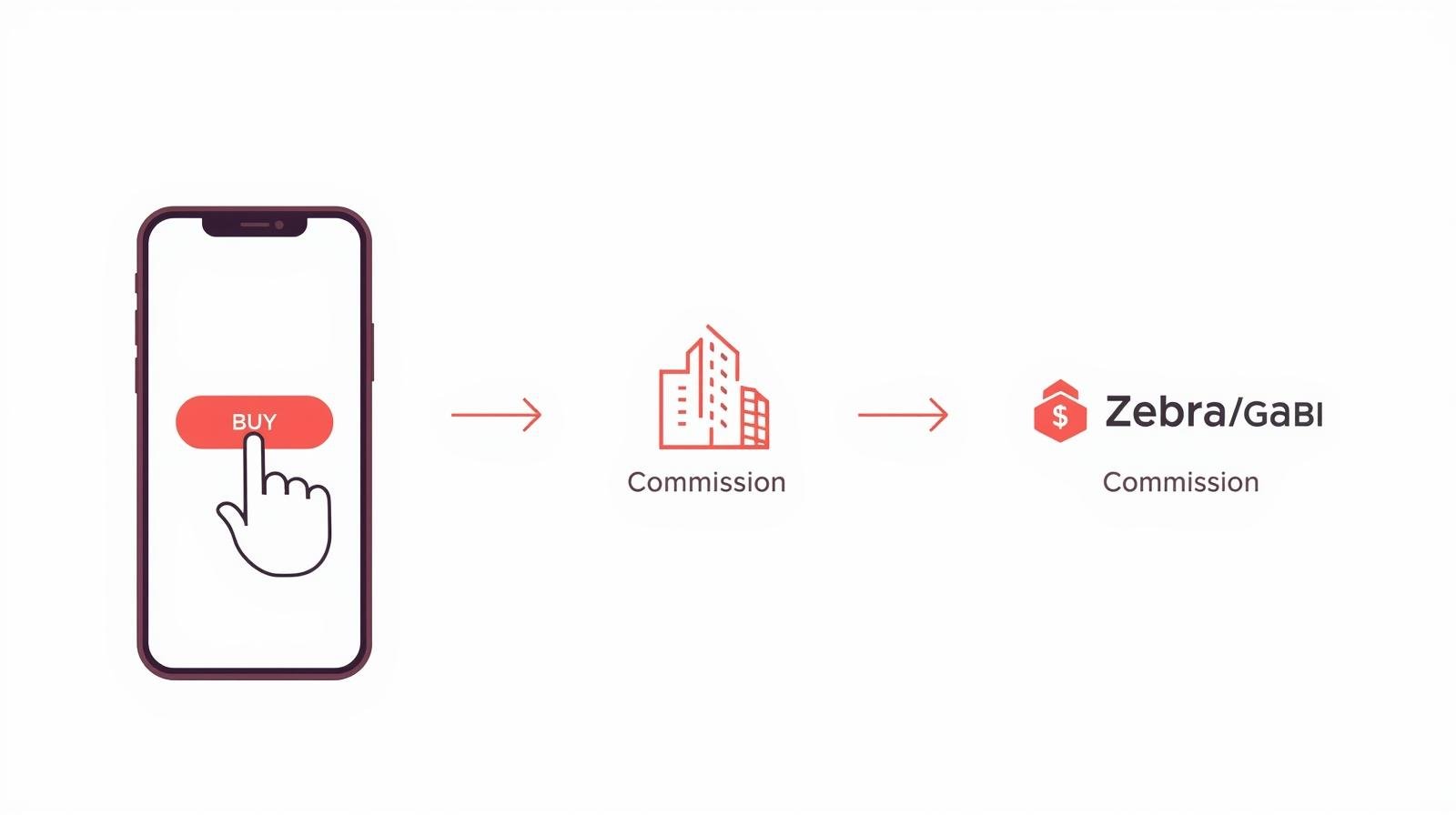

Before we can judge their bias, we need to understand their business model. These platforms, often called “insurance aggregators,” are not insurance companies. They are essentially high-tech insurance brokers.

Here’s the process I experienced: insurance management app review

- You provide your data: I entered my personal details, car information, and current policy details.

- They fetch quotes: Their technology instantly connects with dozens of their partner insurance companies to get real-time quotes.

- You see a comparison: They present these quotes in an easy-to-compare list.

So, how do they make money? It’s simple: when you choose a policy and buy it through their platform, the insurance company pays them a commission. This is a critical point. They are free for you to use, but they are paid by the companies on their platform.

The Million-Dollar Question: Are They Unbiased?

This is where things get interesting. Based on my investigation, the answer is mostly yes, but with some important caveats.

The Case for Being Unbiased

From my experience using these apps, they don’t seem to push one major provider over another in an obvious way. Their main goal is to get you to switch to any policy through their platform because that’s how they get paid.

- Broad Comparisons: I was shown quotes from a wide range of companies, from huge names like Progressive and Allstate to smaller, more niche providers. The sheer volume of options feels transparent.

- Focus on Price: The primary sorting feature is always price. They are built to show you who is cheapest, and in my tests, the cheapest options were always at the top, regardless of the company.

The Potential for Bias (The Caveats)

While they don’t seem to favor specific companies, the bias can creep in through which companies they partner with.

- They Don’t Show Every Company: An aggregator can only show you quotes from insurers they have a partnership with. Some major companies, like State Farm, often don’t participate in these marketplaces because they rely on their own agent networks. So, while you’re getting a great comparison, you might not be seeing 100% of the market.

- Sponsored Placements or “Featured” Partners: Some comparison sites (in many industries, not just insurance) have been known to offer “featured” spots to partners who pay more. While I didn’t see obvious evidence of this skewing the price rankings on the apps I tested, it’s a potential conflict of interest to be aware of. The business model incentivizes them to get you to pick a partner, any partner, from their list.

My Final Verdict: An Honest Insurance Management App Review

After using these tools and digging into their models, here is my final take for this insurance management app review:

Yes, you can and should trust these apps as a powerful starting point. They are incredibly valuable for quickly getting a snapshot of the market and finding out if you’re overpaying. For the vast majority of people, they will find you a cheaper deal than what you currently have.

However, treat them as a trusted advisor, not as the absolute final word.

- Use them to do 90% of the work: Let them run the numbers and identify the top 3-4 cheapest providers for you.

- Do the final 10% yourself: Before making a final decision, consider getting a direct quote from one or two major insurers not on their platform (like State Farm) just to be sure you’ve covered all your bases.

Think of them as a super-efficient research assistant. They do the hard work for you, but the final decision should always be yours, armed with the information they provide. They are not biased in a malicious way, but their view is limited to the partners in their system.

Leave a Reply