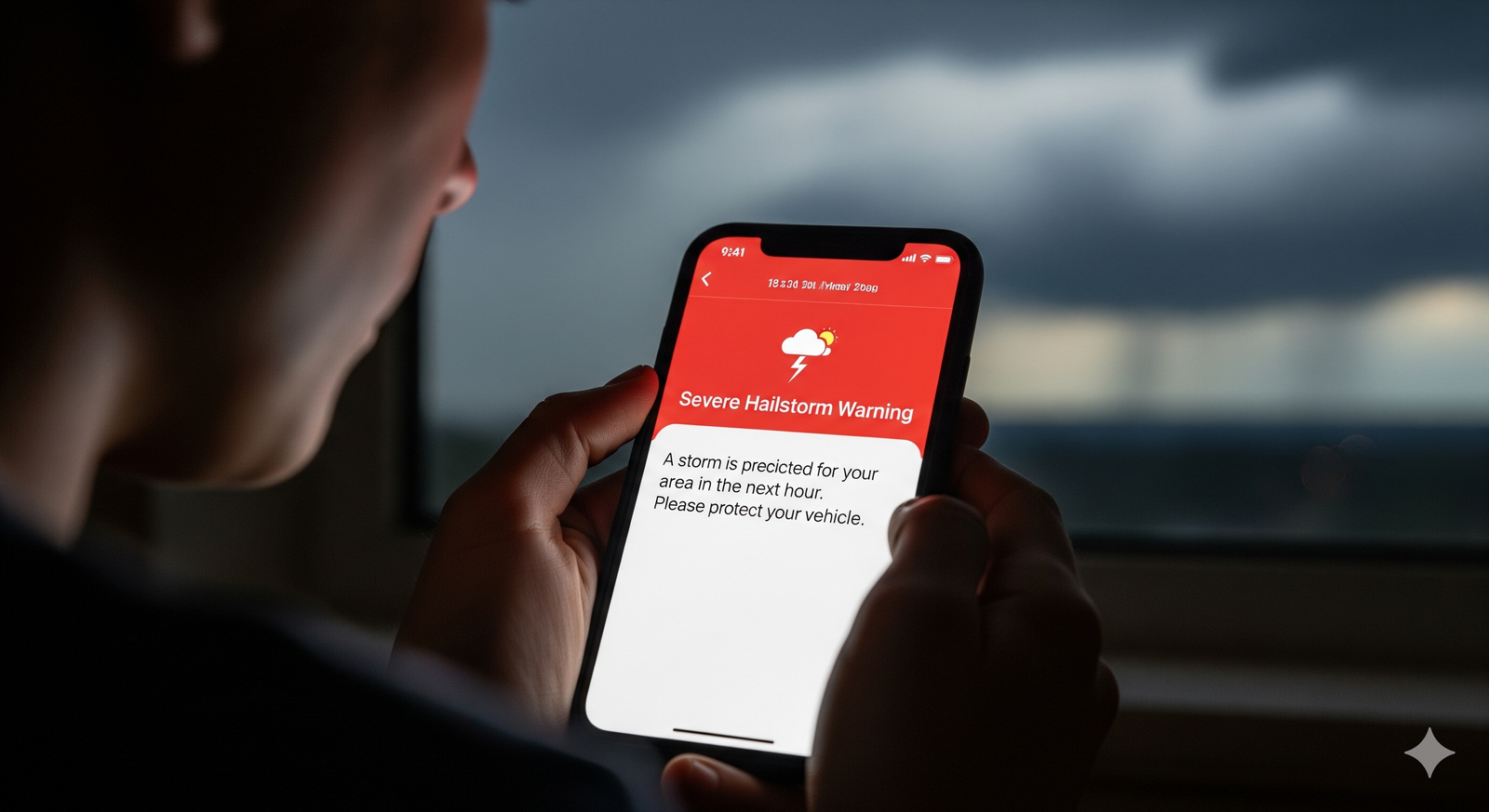

Hey everyone! I’m Adnan from The Insurtech Guide. We usually think of our insurance company as someone we call after a disaster strikes. But what if your insurer could warn you before the storm even hits? What if they could give you a crucial heads-up to move your car before a hailstorm or secure your patio furniture before a major windstorm?

This isn’t a futuristic idea; it’s a reality today thanks to proactive InsurTech. I’ve always been a fan of technology that keeps me one step ahead, so I decided to explore the insurance severe weather alerts offered by my own provider. I was amazed at how simple it was to set up and how much peace of mind it offered.

In this guide, I’ll walk you through the exact steps to find and activate these life-saving notifications. It’s a simple action that can save you thousands in potential damages and, most importantly, help keep your family safe.

Table of Contents

Why These Alerts Are a Game-Changer

Before we get to the “how-to,” let’s quickly cover why these alerts are so much better than a standard weather app. While a weather app might tell you a storm is coming to your city, alerts from your insurer are often much more specific and actionable.

Because they know your exact address and what you have insured (your home, your car), their natural disaster notifications can be hyper-targeted. They are moving from just insuring your property to actively helping you protect it. This is a massive shift in the insurance model and a huge win for us as customers.

This is the true power of getting insurance severe weather alerts directly from the company that protects your assets.

A Step-by-Step Guide to Activating Your Alerts

Most modern insurance companies, especially those with a strong digital presence, now offer some form of proactive weather alerts. The process is usually very similar across different apps. Here is the general guide based on my own experience.

Step 1: Download Your Insurer’s Mobile App

If you haven’t already, the first step is to download your home or auto insurance provider’s official app from the App Store or Google Play. This app is the central hub for most modern features, including alerts. Log in with your policy information.

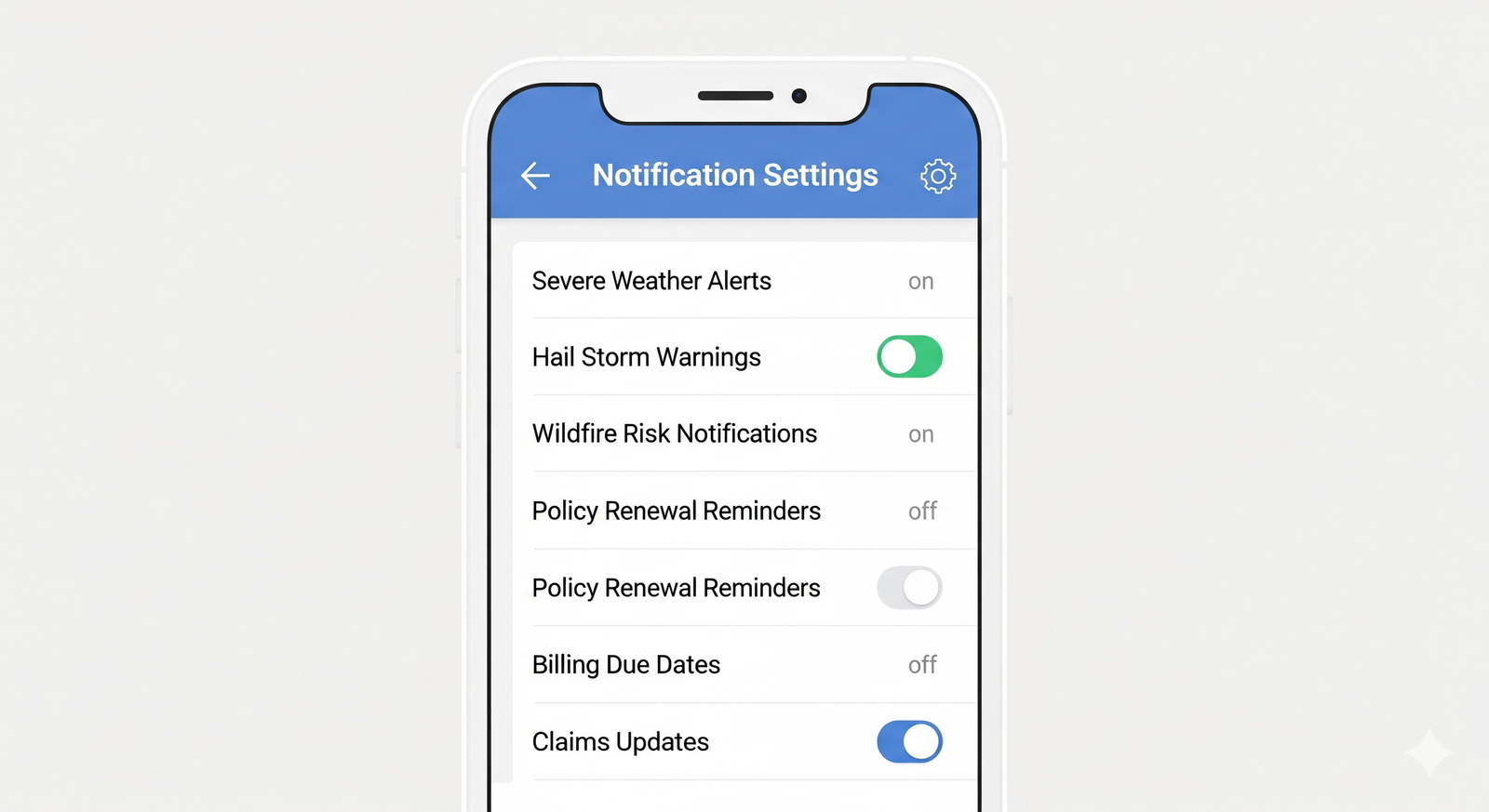

Step 2: Find the “Settings” or “Notifications” Menu

Once you’re logged in, look for a section in the app that controls your account settings. In my experience, this is usually represented by a gear icon (⚙️) or found in a menu under “My Account” or “Profile.” Inside this menu, you should find an option for “Notifications,” “Alerts,” or “Communication Preferences.”

Step 3: Enable Push Notifications and Location Services

This is the most critical step. For the alerts to work, you need to give the app two permissions:

- Push Notifications: In the app’s notification settings, make sure you toggle on the options for “Severe Weather,” “Storm Alerts,” or “Safety Notifications.” This allows the app to send you a message directly to your phone’s home screen.

- Location Services: The app needs to know your location to send you accurate, timely warnings. You’ll usually be prompted to allow the app to access your location. I recommend choosing “Allow While Using App” or “Always Allow” for the best results.

Step 4: Customize Your Alert Preferences

Many apps allow you to choose what kind of alerts you want to receive. For example, you might be able to opt-in specifically for:

- Hail Storm Alerts

- High Wind Warnings

- Wildfire Risk Notifications

- Flood Warnings

I recommend enabling all available safety alerts. It’s better to be over-informed than caught by surprise.

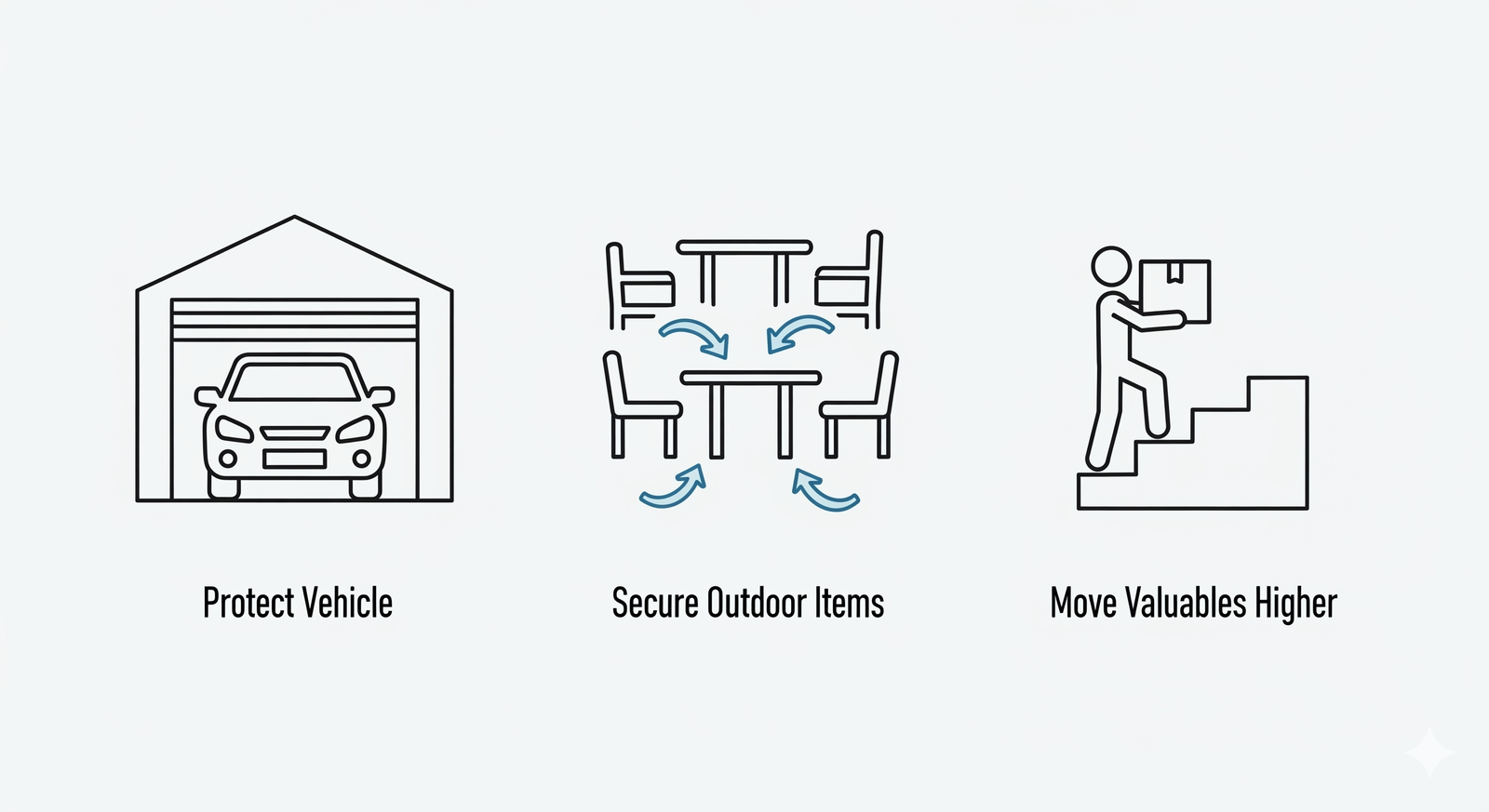

What to Do When You Get an Alert

Receiving an alert is just the first step. The real value comes from taking action. Insurers often pair their alerts with a storm preparedness checklist. When you get a warning, consider these actions:

- Hail Alert: Move your car into a garage or under a covered structure.

- Wind Alert: Secure loose items in your yard like patio furniture, grills, and trampolines.

- Flood Alert: Move valuable items from your basement to a higher floor.

By setting up these insurance severe weather alerts, you are turning your insurance policy from a simple safety net into a proactive partner in protecting your home and family. It’s a free, powerful feature that every policyholder should be using.

Leave a Reply