Hey everyone! I’m Adnan from The Insurtech Guide. For a long time, the idea of working from a laptop on a beach in another country felt like a distant dream. But today, “digital nomads” and “expats” are a growing global community. This new lifestyle of freedom and travel, however, comes with a unique set of challenges—and one of the biggest is health insurance.

Traditional travel insurance is designed for short vacations, not for someone who lives and works abroad for months or even years at a time. I discovered this the hard way when planning a long-term trip. My regular insurance was useless, and the old-school expat plans were incredibly expensive and complicated.

That’s when I turned to a new breed of InsurTech companies designed specifically for us. In this insurance for digital nomads review, I’ll share my hands-on experience with one of the most popular platforms, SafetyWing, and break down if this new model of insurance is the right fit for a life on the road.

Table of Contents

The Unique Problem: Why Normal Insurance Fails

Before we dive into the review, it’s important to understand why digital nomads need a special kind of insurance.

- Short-Term vs. Long-Term: Vacation insurance usually has a strict trip-duration limit (e.g., 30 days).

- Flexibility: Nomads often don’t have a fixed return date. We need a policy that can be extended or paused easily.

- Home Country Coverage: Many travel plans don’t cover you if you make a short visit back to your home country.

- Cost: Traditional expat health plans are designed for corporate executives and can be extremely expensive.

This is the gap that companies like SafetyWing aim to fill. They offer travel medical insurance built on a flexible, subscription-based model.

My Experience with SafetyWing: A Step-by-Step Look

I decided to sign up for SafetyWing to see how the process really works for someone planning a multi-country trip.

Step 1: The Sign-Up Process

The sign-up was refreshingly simple. I went to their website, entered my basic details, my start date, and paid with my credit card. There were no long medical questionnaires or complicated forms. The entire process took less than five minutes. It felt more like signing up for Netflix than buying an insurance policy.

Step 2: The Subscription Model (The Game-Changer)

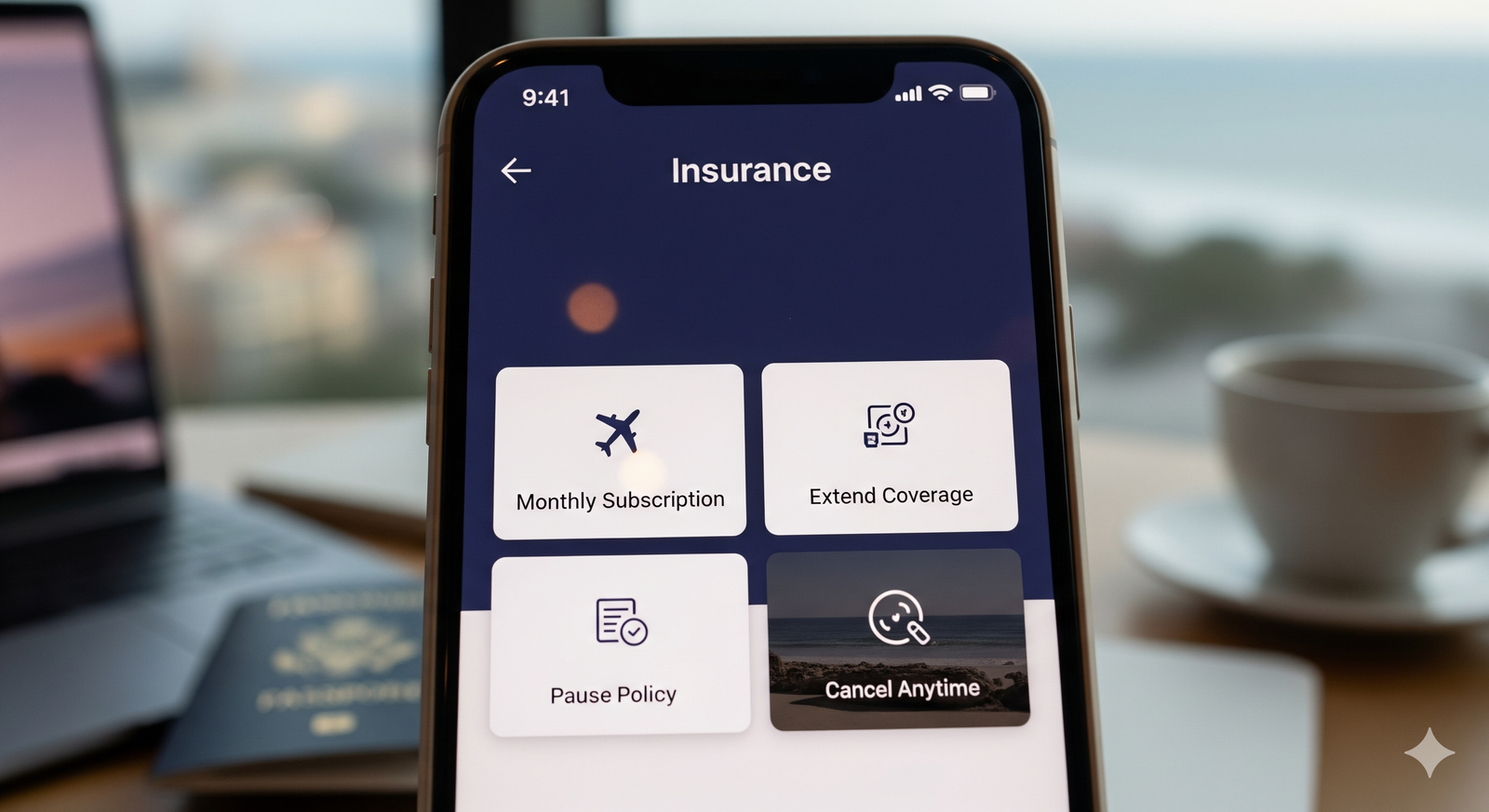

This is SafetyWing’s standout feature. Instead of buying a policy for a fixed term (e.g., 6 months), you start a subscription.

- How it works: You are automatically billed every 28 days until you pick an end date. This provides incredible flexibility. If my travel plans changed, I could cancel or extend my coverage at any time. This is a perfect fit for the unpredictable nature of the nomadic lifestyle.

Step 3: The Coverage Details

This is the most critical part of any insurance for digital nomads review.

- What’s Covered: SafetyWing primarily acts as travel medical insurance. It covers you for unexpected accidents and illnesses while you’re outside your home country. It includes hospital care, doctor visits, and emergency medical evacuation. It also covers short visits back to your home country after you’ve been abroad for a certain period.

- What’s NOT Covered: It’s important to know that this is not a comprehensive primary health plan. It doesn’t cover routine check-ups, preventative care, or pre-existing conditions. It’s designed for emergencies, not for managing your long-term health. They also have limited coverage for some adventure sports.

The Pros and Cons: An Honest Breakdown

An Honest Insurance for Digital Nomads Review: The Pros & Cons

| Pros | Cons |

| ✅ Incredible Flexibility: The subscription model is perfect for long-term, unpredictable travel. | ❌ Not a Primary Health Plan: Doesn’t cover routine check-ups or pre-existing conditions. |

| ✅ Very Affordable: It’s one of the most cost-effective options on the market for basic travel medical coverage. | ❌ Limited Adventure Sports Coverage: You may need to buy an add-on for activities like scuba diving or rock climbing. |

| ✅ Simple and Transparent: The website is easy to use, and the policy is easy to understand. | ❌ High Deductible: The plan comes with a deductible, meaning you have to pay a certain amount out-of-pocket before insurance kicks in. |

Final Verdict: Is SafetyWing the Right Choice for You?

After my deep dive, I can say that SafetyWing is an excellent and almost essential tool for a specific type of traveler.

This insurance is perfect for you if:

- You are a digital nomad or long-term traveler on a budget.

- You need a flexible medical safety net for emergencies while you are abroad.

- You already have primary health insurance in your home country for routine care.

However, if you are an expat looking for a full-fledged health plan to replace your home country’s insurance, or if you have significant pre-existing conditions, you would need to look for a more comprehensive (and more expensive) global health plan.

It brilliantly solves the problem of accessible and affordable emergency medical coverage, making it a top contender in any insurance for digital nomads review.

For the modern remote worker, SafetyWing brilliantly solves the problem of accessible and affordable emergency medical coverage, making the freedom of a nomadic lifestyle just a little bit safer.

Leave a Reply