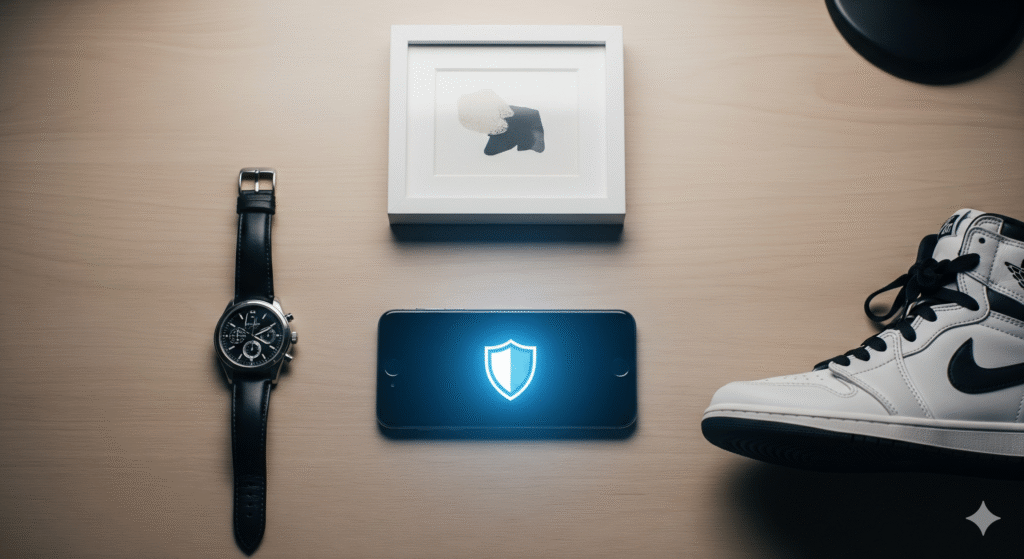

Hey everyone! I’m Adnan from The Insurtech Guide. Like many of you, I have a passion that goes beyond just a hobby—I’m a collector. For me, it’s vintage watches. For you, it might be rare sneakers, designer handbags, or even comic books. These aren’t just things; they’re valuable assets that we’ve spent years curating.

For the longest time, I just assumed my homeowners insurance would cover them if something happened. But after a close call with a water leak scare, I did some digging and discovered a shocking truth: most standard home insurance policies provide very little coverage for high-value collectibles. They often have low payout limits ($1,500 is common) for items like jewelry or other collections.

I knew I needed specialized protection but dreaded the thought of going through a traditional broker for something so specific. So, I turned to the world of InsurTech to find a modern solution. In this guide, I’ll walk you through my personal experience and show you exactly how to insure a high-value collection using a simple, app-based approach.

Table of Contents

Why Your Standard Home Insurance Isn’t Enough

Before we dive into the “how,” it’s crucial to understand the “why.” Your standard renters or homeowners policy is great for covering your couch or your TV, but it falls short when it comes to collectibles. Here’s why:

- Low Coverage Limits: As I mentioned, most policies have a very low cap (e.g., $1,500 to $2,500) for specific categories like jewelry, watches, or art. If your collection is worth $10,000, you’d be massively underinsured.

- Limited Perils: A standard policy usually only covers specific “perils” like fire and theft. It might not cover accidental damage, loss, or other unique risks associated with collectibles.

- Lack of Specificity: Standard policies don’t list individual items. Proving the value of a rare item after it’s gone can be a nightmare.

This is where specialized collectibles insurance, often called a “personal articles floater,” comes in. It’s a separate policy designed specifically for your valuables. This is why learning how to insure a high-value collection properly is so critical.

How to Insure a High-Value Collection: The App-Based Solution

I was thrilled to find that a new wave of InsurTech companies has made this process incredibly simple. I decided to use an app to insure my watch collection. Here’s a step-by-step breakdown of my experience.

Step 1: Finding the Right App

My first step was to find an InsurTech company specializing in valuables. A quick search led me to apps like Bling or WAX. These platforms are designed from the ground up to make insuring specific items easy.

Step 2: Cataloging Your Collection (The Fun Part)

This is where the app experience shines. Instead of filling out endless forms, I simply had to:

- Take a photo of each watch in my collection with my phone.

- Upload a receipt or a past appraisal as proof of ownership and value. For some of my older watches, a detailed description and photos were enough to get started.

- Enter a brief description of the item (e.g., “Rolex Submariner, 1985”).

The app created a beautiful digital catalog of my entire collection, with each item and its value clearly listed.

Step 3: Getting an Instant, Itemized Quote

Once my collection was cataloged, the app gave me an instant quote. The best part was that the quote was completely transparent. I could see the exact annual premium for each individual item. If I wanted to save money, I could choose to insure only the most valuable pieces. This level of control is something I’d never experienced with traditional insurance.

Step 4: Securing the Policy

After reviewing the quote, I paid for the policy directly through the app with my credit card. Within minutes, I had a full, legally binding insurance policy for my collection delivered to my email and available in my digital insurance wallet on the app. The entire process, from download to being fully insured, took less than 30 minutes.

Final Verdict: Is Using an App the Best Way?

From my experience, if you have a collection of any significant value, using a specialized InsurTech app is a no-brainer. The process is faster, more transparent, and gives you far more control than any traditional method.

You get a clear record of your collection, an itemized premium, and the peace of mind that comes from knowing your passion is properly protected. Don’t rely on your standard home insurance; take the extra step to get the specialized coverage your collection deserves.

Leave a Reply