Hey everyone! I’m Adnan from The Insurtech Guide. We’re getting used to the idea of our direct behavior impacting our insurance. Our telematics data can lower our car insurance, and our smart home sensors can lower our home insurance. But what’s the next frontier?

I’ve been tracking a fascinating and, frankly, a slightly scary idea that’s being discussed in the depths of the InsurTech world: what if your entire online life—the posts you ‘like,’ your shopping habits, your search history—could be used to calculate your insurance premiums?

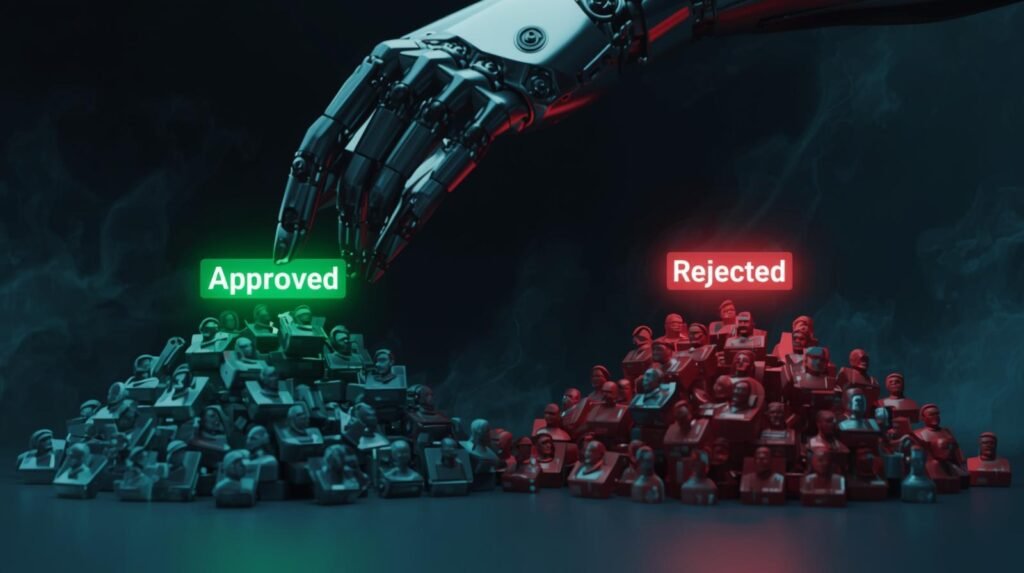

This is the core question behind the concept of using your digital footprint for insurance rates. Is this an inevitable future of hyper-personalization, or is it a dangerous step into a world of digital discrimination? I decided to investigate the arguments for and against this controversial trend.

Table of Contents

First, What is Your “Digital Footprint”?

Your digital footprint is the trail of data you leave behind every time you use the internet. It’s a vast and incredibly detailed picture of your life and personality. It includes:

- Social Media Activity: The posts you share, the pages you follow, the people you interact with.

- Online Shopping Habits: What you buy, how often you shop, and from where.

- Search History: The questions you ask and the topics you research.

- App Usage: The apps you download and how you use them.

Individually, these data points seem small. But together, they create a powerful profile that AI can analyze to predict future behavior.

The Argument For It: A More Accurate Picture of Risk?

From an insurer’s perspective, the logic is about creating a more accurate and nuanced picture of a person’s risk profile. The argument is that the data from your digital footprint can be a better predictor of risk than the old, biased proxies like zip code or credit score.

Here’s how they might see it:

- Health Insurance: Someone whose online shopping is full of healthy foods, gym memberships, and fitness gear might be seen as a lower health risk.

- Life Insurance: A person whose social media is filled with posts about extreme sports like skydiving or mountain climbing could be considered a higher risk.

- Auto Insurance: An AI might find a correlation between people who search for “street racing videos” and those who get into more accidents.

The goal, in theory, is to move towards a system based on your demonstrated lifestyle and interests, which could be a more accurate way to set digital footprint insurance rates.

The Argument Against It: A Privacy and Ethical Nightmare

This is where the idea becomes deeply concerning for me and many other privacy advocates.

1. The Massive Invasion of Privacy:

The most obvious problem is the staggering invasion of privacy. It would mean giving insurance companies an unprecedented window into our private lives, thoughts, and behaviors.

2. The Danger of Algorithmic Bias:

This is the biggest risk. An AI model could create new, unfair forms of discrimination. For example:

- What if the AI learns that people who listen to a certain type of music are statistically more likely to be involved in accidents?

- What if it decides that people who buy budget-brand groceries are a higher health risk?

This creates a “digital redlining” system where you are judged and penalized for your tastes and associations, which is deeply unfair.

3. Correlation is Not Causation:

Just because an AI finds a statistical link between two things (like liking a certain Facebook page and filing a claim) doesn’t mean one causes the other. Using such flimsy correlations to set essential financial rates is an ethical minefield.

Is This Happening Now?

This is the crucial question. For the most part, in highly regulated markets like the US and Europe, the answer is no. Insurers are strictly regulated and are not allowed to use your social media posts or browsing history to set your rates for standard policies like auto or home insurance.

However, this alternative data is already being used in other ways, such as for fraud detection or in less-regulated markets. The technology exists. The only things stopping it are regulations and public backlash.

Final Verdict: A Dangerous Path or an Inevitable Future?

The idea of using our full digital footprint for insurance rates is a chilling one. It trades far too much privacy for a questionable increase in accuracy and opens the door to new and insidious forms of bias.

However, the underlying trend is undeniable: insurers will always seek more data to personalize premiums. The real battle for our generation will be to draw a clear, ethical line in the sand. We need to define what data is relevant and fair to use (like telematics for car insurance) and what is an unacceptable intrusion into our private lives.

Leave a Reply