Hey everyone! I’m Adnan from The Insurtech Guide. Have you ever been booking a flight online, and right before you pay, a little checkbox pops up: “Add travel insurance for just $15”? It’s so easy, so tempting. You just tick the box and you’re done. That, my friends, is embedded insurance.

I’ve always been fascinated by this trend. On one hand, it’s the peak of convenience. On the other, I’ve always wondered what I’m really buying with that single click. Is it as good as a traditional, separate policy that I research and buy myself?

This question led me to compare the two models head-to-head. In this guide, I’ll break down the real difference between embedded insurance vs standalone policies, using my own experience to help you decide which is the right choice for your next trip.

Table of Contents

What is Embedded Insurance? The Rise of Point-of-Sale Protection

Embedded insurance is the practice of bundling an insurance product directly with the purchase of another service or product. That checkbox on the airline website is a perfect example. You’re not visiting an insurance website; the insurance is coming to you right at the point of sale.

I’ve seen it everywhere recently:

- Adding phone protection when buying a new smartphone.

- Getting renters insurance as an add-on when signing a new lease online.

- And, most commonly, adding trip protection plans when booking flights or hotels.

The appeal is obvious: it’s incredibly convenient and removes all the friction from the buying process.

What is a Standalone Policy? The Traditional Approach

A standalone policy is what we traditionally think of as insurance. It’s a separate, comprehensive plan that you research and buy directly from an insurance company or a comparison site (like World Nomads or a local provider).

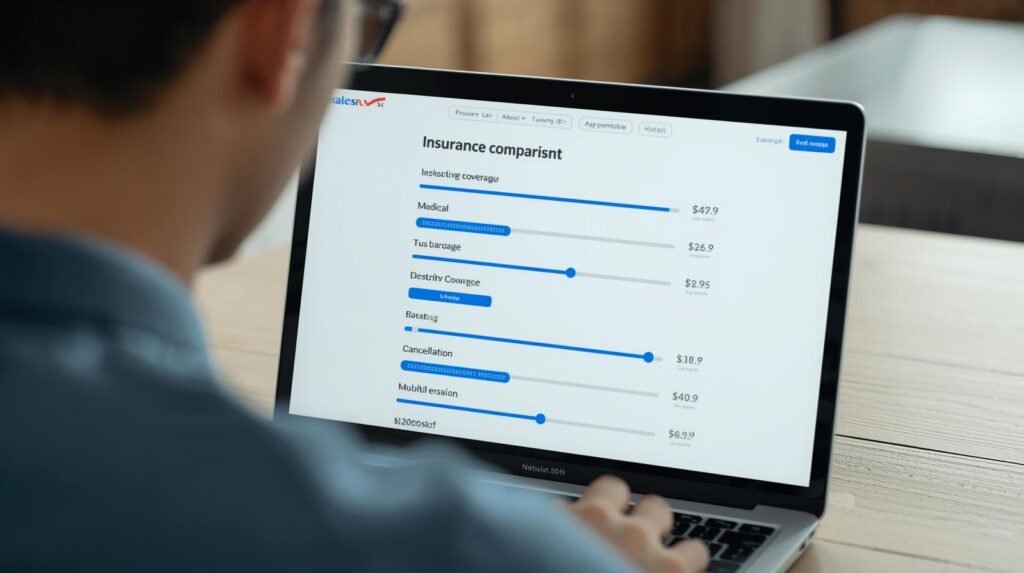

The process involves actively seeking out a policy, comparing different levels of coverage (for medical emergencies, lost luggage, cancellations), and making a dedicated purchase. It requires more effort, but it also gives you more control.

Embedded Insurance vs Standalone: A Head-to-Head Comparison

When I was booking a recent international trip, I decided to get quotes from both models. Here’s how they stacked up in the key areas that matter most.

1. The Buying Process

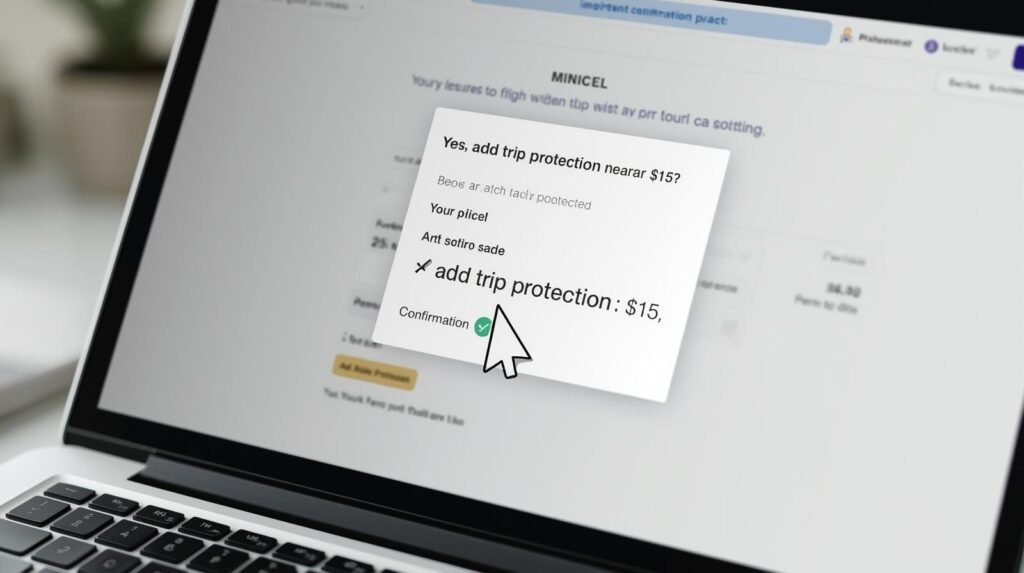

- Embedded Insurance: The experience was seamless. It took me about 5 seconds to tick the box. There were no extra forms and no decisions to make. It was an impulse buy, and the cost was simply added to my flight ticket.

- Standalone Policy: This required more work. I spent about 30-45 minutes on a comparison site, reading through different plans, checking coverage limits for medical expenses and lost baggage, and filling out my travel details. It was a more involved and deliberate process.

Winner for Convenience: Embedded Insurance, by a landslide.

2. Coverage Details

This is where the real difference became clear.

- Embedded Insurance: The policy offered was a basic, one-size-fits-all plan. It covered trip cancellation for a few specific reasons but had very low limits for medical emergencies and lost luggage. When I tried to find the detailed policy document, it took some digging. The coverage felt more like a “peace of mind” add-on than a robust safety net.

- Standalone Policy: I had complete control. I could choose a cheap, basic plan or a more expensive, comprehensive one. I was able to select a policy with high medical coverage (which was important to me) and specific protections for my camera gear. The terms were clear and presented upfront.

Winner for Coverage & Control: Standalone Policy, without a doubt.

3. Cost

At first glance, the embedded option seemed cheaper. The airline offered it for a low price. However, when I compared it to a similar basic plan on a standalone site, the prices were almost identical. The difference was that the standalone site also gave me the option to buy much better coverage for a slightly higher price—an option the embedded product never offered.

Winner for Price: It’s a tie, but only if you’re comparing identical, basic plans. Standalone gives you more value options.

Final Verdict: Embedded Insurance vs Standalone – Which Should You Choose?

After my experience, my conclusion is that the better choice depends entirely on the nature of your trip and your personal risk tolerance.

You should choose Embedded Insurance if:

- You are taking a short, inexpensive domestic trip.

- Your biggest concern is simply cancelling the flight and getting your ticket price back.

- You value extreme convenience above all else and just want basic protection.

You should choose a Standalone Policy if:

- You are traveling internationally, where medical emergencies can be incredibly expensive.

- You are carrying valuable items like a laptop, camera, or sports equipment.

- You want comprehensive coverage for a wide range of issues (lost luggage, travel delays, medical evacuation).

- You want to have control and be able to choose your own coverage limits.

In short, embedded insurance is a fantastic innovation for low-risk scenarios. But for any trip that is a significant investment or involves international travel, the depth and control of a standalone policy are, in my opinion, essential. In the end, the choice in the embedded insurance vs standalone debate comes down to your specific needs for each trip.

Leave a Reply